41 gift card rules by state

Gift Cards | Federal Trade Commission These rules apply to two types of cards: Retail gift cards, which can only be redeemed at the retailers and restaurants that sell them; and bank gift cards, which carry the logo of a payment card network like American Express or Visa and can be used wherever the brand is accepted. Picking Up a Gift Card? New Laws in Effect in New York State - NBC New York The new law also prohibits fees previously associated with card, including service fees, renewal fees, activation fees, and access fees. The one exception: "A gift card or gift certificate that is ...

Gift Card Laws: State by State | CardPrinting.com Gift Card Laws: State by State About CardPrinting.com CardPrinting.com is a division of Tele-Pak, Inc., a leading global provider of plastic card printing since 1996. Our services include: Gift Cards, Membership Cards, Fundraising Cards, Hotel Key Cards, PVC Cards, Plastic Key Tags, Point of Sale Activation (POSA) Cards and more.

Gift card rules by state

Gift Cards Expiration Laws - A State By State Review - Class Action It's important to understand what you're buying according to the state in which you buy and use a gift card. Maximum post-sale fee limit Minimum time frame before charging fees Merchants Required To Offer Cash back Balance Escheats to State Unknown: Kansas, Kentucky, Missouri, Oregon, South Carolina Cards and Certificates Legally Defined New York Legislation on Gift Cards Passes Senate Senate Bill 8780 would prohibit most fees associated with closed-loop gift cards, including activation, redemption, monthly, dormancy, latency, administrative, access, re-loading fees (and quite a few more similar fees). This would change the 2016 law that changed the time from 13 to 25 months before a fee could be imposed. Texas State - Frequently Asked Legal Questions unlike texas law, federal law does contain restrictions on expiration dates. 15 usc 1693l-1 (c) states that " [a] gift certificate, store gift card, or general-use prepaid card may contain an expiration date if the expiration date is not earlier than 5 years after the date on which the gift certificate was issued, or the date on which card funds …

Gift card rules by state. Gift cards: clarifying the laws in Maine and Tennessee Federal law generally prohibits the sale of a gift card that expires sooner than five years after the date when funds were last loaded onto the card. At the same time, unclaimed property laws in Maine and Tennessee consider some gift cards abandoned property as early as two years after purchase. All About the Gift Card Refund Law - DoNotPay The gift card refund law refers to the cash back policy that several U.S. states and territories have regarding the gift cards and certificates sold after January 1, 1997. The law states that if the customer requests a refund, a company or restaurant is required to: Redeem a gift card or certificate for its cash value. Gift Cards & Gift Certificates - Michigan State and federal consumer laws offer gift card consumers many protections, including required disclosures, limits on fees and expiration dates, and access to replacement cards. This Alert explains the different types of gift cards and the rules designed to protect consumers. Gift Cards and Gift Certificates Statutes and Legislation The law provides that gift cards cannot expire within five years from the date they were activated and generally limits inactivity fee on gift cards except in certain circumstances, such as if there has been no transaction for at least 12 months.

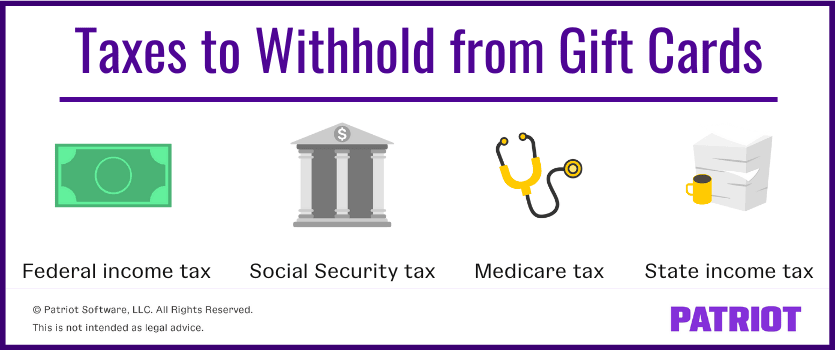

New Gift Card Laws | Consumer Law With some exclusions, the fundamentals are: a minimum three year expiry period for gift cards is required; gift cards must display expiry dates; and most post purchase fees on gift cards are banned. Three-year minimum expiry period The law requires that most gift cards or vouchers be sold with a mandatory minimum expiry period of three years. Are Gift Cards Taxable? | Taxation, Examples, & More - Patriot Software Yes, gift cards are taxable. According to the IRS, gift cards for employees are considered cash-equivalent items. Like cash, include gift cards in an employee's taxable income—regardless of how little the gift card value is. But, there is an exception. You might be able to exclude gift cards you give employees for a specific item of minimal ... New state rules for gift cards begins December 10 No Law Requiring a Minimum Expiration Term. 5-years from date of purchase before gift card can expire. 5-years from date of purchase before the gift card can expire. 9-years from the date... New state rules for gift cards begins December 10 NFL levies $550,000 in fines for allegedly fake Cam Jordan injury on Monday night. Yes, they were serious about that. The NFL issued a memo to all teams on Friday, December 2, regarding the faking of injuries — and the punishment to be imposed on teams, coaches, and players when fake injuries happen. The NFL has decided that, on Monday ...

Gift Cards: Know Your Rights | PrivacyRights.org The National Conference of State Legislatures maintains a comprehensive list of state gift card laws. ... With some retailers filing for bankruptcy, you should be aware of the rules governing gift cards in a bankruptcy proceeding. A gift card from a retailer that seeks bankruptcy protection may lose its value. However, the holder of the gift ... Must-Know Tax Rules for Employee Gift Cards: 2022 Update - Giftogram In fact, any gift card you award to a customer or prospect is non-taxable, whether it's a just-because gift, a customer incentive, a loyalty reward, or a prize won through a promotional contest. Tax Rules for Gift Cards to Employees Gift cards to employees are always taxable, but following the rules doesn't have to be time-consuming or complicated. 12 CFR § 205.20 - Requirements for gift cards and gift certificates. The terms "gift certificate," "store gift card," and "general-use prepaid card", as defined in paragraph (a) of this section, do not include any card, code, or other device that is: (1) Useable solely for telephone services; (2) Reloadable and not marketed or labeled as a gift card or gift certificate. For purposes of this paragraph ... New gift card laws in effect - WNYT.com NewsChannel 13 Just in time for the holidays, new laws involving gift cards go into effect today in New York State. Any gift cards or gift certificates bought in New York on or after today will remain valid for ...

FDIC Consumer News: What You Should Know About Gift Cards Bank gift cards, which carry the logo of a payment card network (e.g., Visa, MasterCard), are also subject to Credit CARD Act protections and can be used wherever the brand is accepted. Under the law, a gift card cannot expire until at least five years from the date it was activated. The law also places general limitations on fees.

New Legislation Ends Gift Card and Gift Certificate Fees in New York That means no activation fees, retroactive fees, redemption fees, or any other kind of fee. Consumers can also redeem a gift card or certificate for cash if the value is less than $5. "Gift ...

What Are the Gift Card Laws by State? [Top Info] - DoNotPay Gift Card Laws by State—What You Should Know Some states permit post-sale fees that can be charged after the card has been purchased. These fees include: Maintenance fees—for inactive or dormant cards Transaction fees—a fee for every time you use the card Activation fee—a fee when you use the card for the first time

Gift Card Laws: An Interactive State-by-State Guide - Class Action Gift cards cannot expire before five years from date of purchase Reloadable gift card funds are valid for five years from the date of the most recent reload All gift cards must disclose fees upon either the card itself or associated packaging In states that allow post-sale fees, these fees cannot be imposed until one year of inactivity

Gift Card Laws: The Basics You Need to Know for Your Business The CARD Act: A Federal Gift Card Law. The Credit Card Accountability Responsibility and Disclosure Act of 2009 is a federal law which protects consumers. The act applies to store-bought gift cards, gift certificates and gift cards with a MasterCard, Visa, American Express or Discover logo. Some of the most important excerpts include:

Gift card questions answered | Washington State Ned recently wrote All Consuming to ask, "I bought gift cards at [name of upscale department store] at Christmas and tried to return them last week but was told state law prohibited gift card returns. Is this true?" Actually, it's not true that Washington's law prohibits gift card returns. But most retailers have an "all sales are final" policy.

§ 1005.20 Requirements for gift cards and gift certificates. (2) The following are stated, as applicable, clearly and conspicuously on the gift certificate, store gift card, or general-use prepaid card: (i) The amount of any dormancy, inactivity, or service fee that may be charged; (ii) How often such fee may be assessed; and (iii) That such fee may be assessed for inactivity; and

Gift Card Laws by State 2022 - worldpopulationreview.com In California, any balance less than $10 can be redeemed. Colorado, Maine, Montana, New Jersey, Oregon, and Washington allow cash redemption for balances less than $5. Rhode Island and Vermont will redeem balances less than $1 for cash while Massachusetts will redeem a gift card for cash once 10% of the original value remains.

Fact sheet on state gift card protection laws - CR Advocacy State Gift Card Consumer Protection Laws* The following is a summary of state gift card laws. The Credit CARD Act of 2009 may provide additional gift card protections. The money on store-issued gift cards, as well as bank-issued gift cards cannot expire before 5 years from the date of purchase or when money was last loaded onto a card. Also ...

FAQs and Tips on Gift Certificates and Gift Cards: Legal Guide S-11 the gift certificate law states that a seller must either redeem a gift certificate or gift card sold after january 1, 1997, for its cash value, or replace it with a new certificate or card at no cost. 18 however, california's legislative counsel has concluded that a seller is not required to redeem a gift certificate in cash when requested by a …

Texas State - Frequently Asked Legal Questions unlike texas law, federal law does contain restrictions on expiration dates. 15 usc 1693l-1 (c) states that " [a] gift certificate, store gift card, or general-use prepaid card may contain an expiration date if the expiration date is not earlier than 5 years after the date on which the gift certificate was issued, or the date on which card funds …

New York Legislation on Gift Cards Passes Senate Senate Bill 8780 would prohibit most fees associated with closed-loop gift cards, including activation, redemption, monthly, dormancy, latency, administrative, access, re-loading fees (and quite a few more similar fees). This would change the 2016 law that changed the time from 13 to 25 months before a fee could be imposed.

Gift Cards Expiration Laws - A State By State Review - Class Action It's important to understand what you're buying according to the state in which you buy and use a gift card. Maximum post-sale fee limit Minimum time frame before charging fees Merchants Required To Offer Cash back Balance Escheats to State Unknown: Kansas, Kentucky, Missouri, Oregon, South Carolina Cards and Certificates Legally Defined

:max_bytes(150000):strip_icc()/what-difference-between-prepaid-credit-card-and-gift-card_round2-fb12f0c05cc04888832041224c23a9a3.png)

0 Response to "41 gift card rules by state"

Post a Comment