39 gift card to employee taxable

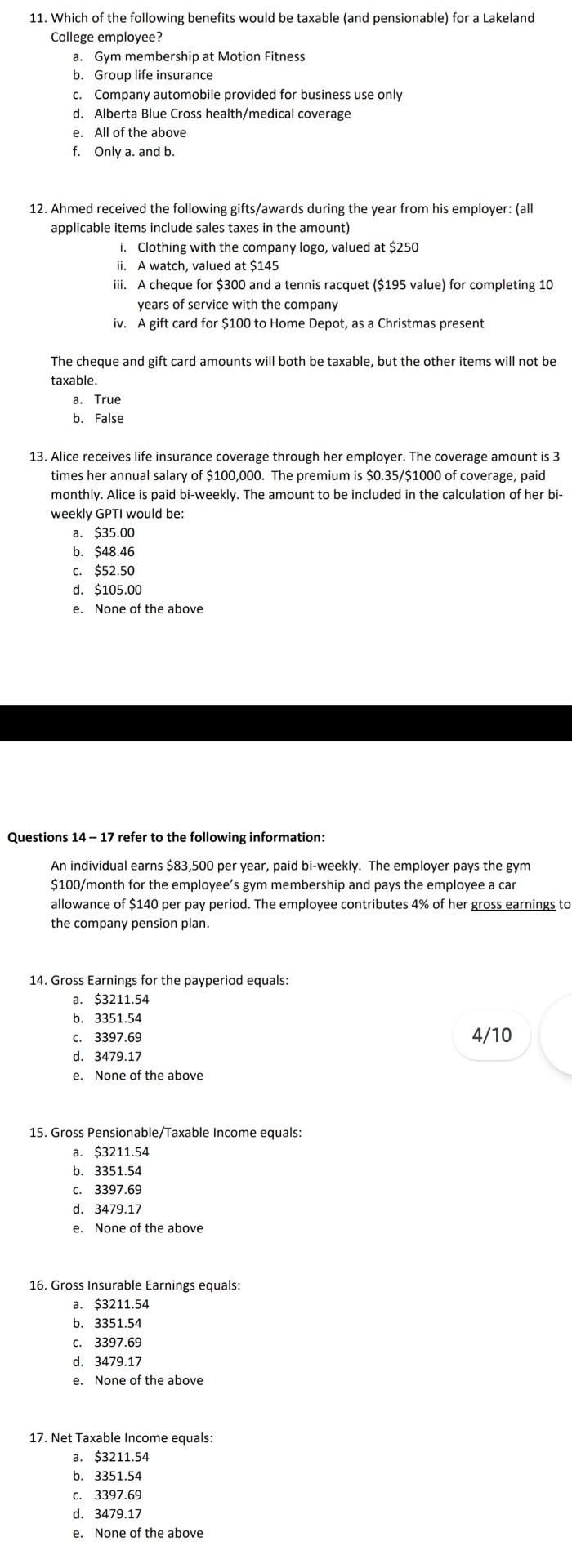

Must-Know Tax Rules for Employee Gift Cards: 2022 Update - Giftogram In fact, any gift card you award to a customer or prospect is non-taxable, whether it's a just-because gift, a customer incentive, a loyalty reward, or a prize won through a promotional contest. Tax Rules for Gift Cards to Employees Gift cards to employees are always taxable, but following the rules doesn't have to be time-consuming or complicated. Tax Rules of Employee Gifts and Company Parties - FindLaw Taxable gifts: Gift certificates (cash in kind) are wages subject to taxes -- even for a de minimis item. For example, a gift certificate for a turkey is taxable, even though the gift of a turkey is not. Cash gifts of any amount are wages subject to all taxes and withholding. Gifts Under $25: Gifts under $25 are typically tax-exempt.

Gifts, awards, and long-service awards - Canada.ca If the FMV of the gifts and awards you give your employee is greater than $500, the amount over $500 must be included in the employee's income. For example, if you give gifts and awards with a total value of $650, there is a taxable benefit of $150 ($650 - $500). There are special rules for Long-service awards.

Gift card to employee taxable

Are gift cards taxable employee benefits? | PeopleKeep Yes, gift cards are taxable when offered to employees. The IRS considers it as cash-equivalent, meaning you must report the card's value on an employee's Form W-2 just like a wage. This is the same as taxable fringe benefits such as employee stipends, which must also be reported as wages on employees' W-2s. Giving Gifts to Employees? IRS Wants Its Share - WFY These perks are tax-free to employees. But any amount of cash or a comparable gift is not treated as a de minimis fringe benefit. Thus, if an employer gives an employee a $50 gift card for a store at the local mall, the employee must report the $50 "gift" as taxable income. Another Exception: Employee Achievement Awards Are Employee Gifts Taxable? Everything You Need To Know Gift certificates, gift cards and cash equivalent benefits are never tax-exempt This is something the IRS is very clear about. Even if they are given out as holiday or birthday presents from an employer to an employee, these types of gifts are never considered de minimis fringe benefits, and are thus liable to taxation.

Gift card to employee taxable. Are Gifts for Your Team and Clients Tax Deductible in the U.S.? Gift cards and gift certificates are considered taxable income to employees because they can essentially be used like cash. The cost of the gift card is fully deductible to the business, but you must withhold taxes from the employee's pay for these gifts. Team Gift Type 3: Awards Are Gift Cards taxable For Employees - Blackhawk On Demand • Employees need to report gift cards and gift certificates as taxable income since these are used in the same way as money. While the expense of the gift card is completely payable by the company, you must pay tax from the worker's compensation for all these incentives. Are Gift Cards Taxable to Employees? - Eide Bailly Are Gift Cards Taxable? Gift cards given to employees count as taxable income and must be reported on Form W-2. However, people often incorrectly assume that IRS rules on gift cards to employees are also covered under de minimis fringe benefit rules. What Are De Minimis Fringe Benefits? Are Gift Cards Taxable? | Workest - zenefits.com Employee earns $15 per hour, 40 hours per week: base wages $600. 25% tax rate ($125) take-home pay is $450. If the employer offers a $100 gift card, base wages increase to $700 per week. 25% tax rate ($175) take-home pay is $425 (plus the $100 gift card). An additional $25 on the gift card offsets the paycheck cash loss.

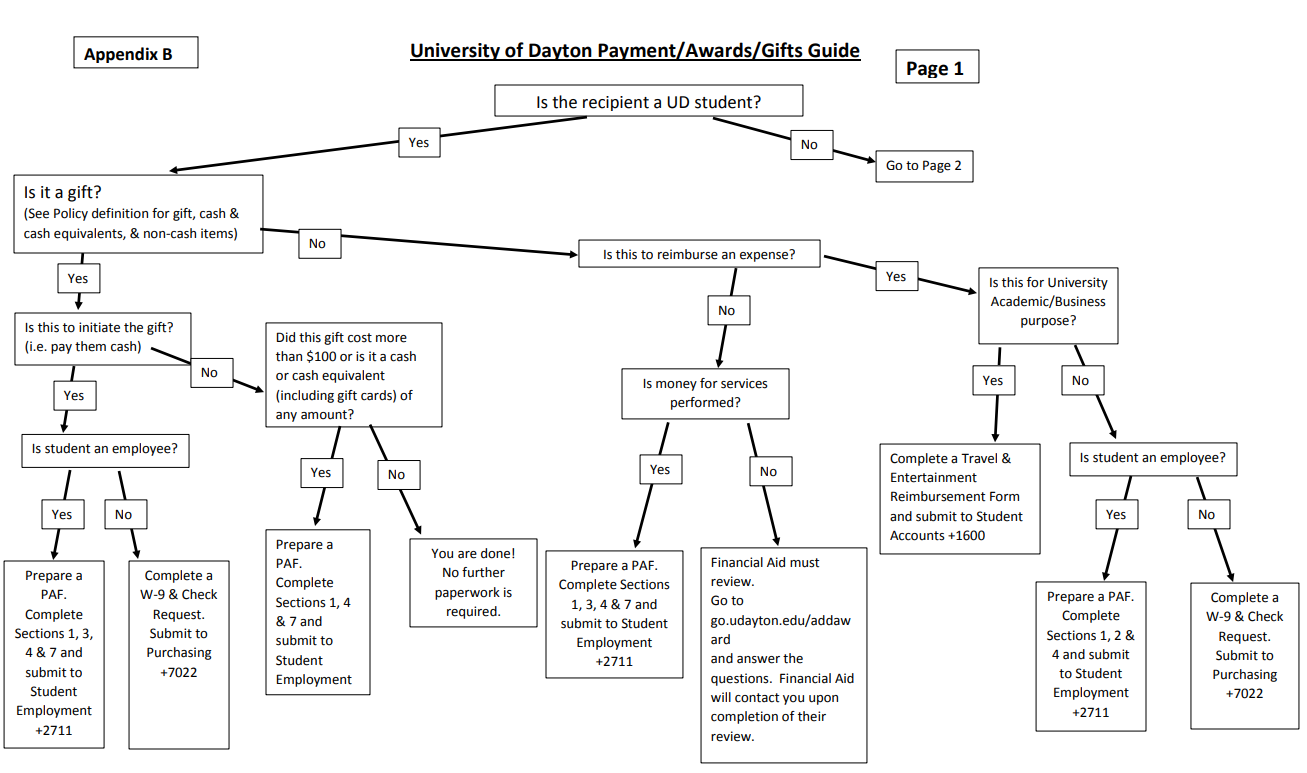

When do you tax gifts certificates, raffle prizes, etc. Most gift cards and gift certificates can't be exchanged for cash these days, but they do have a cash value that is taxable. For other stuff, you're usually okay not taxing it if the value if under $25 (holiday turkeys, t-shirts, etc.). Trips to Bermuda would be taxable. Thanks David for the information. Giving Gifts to Employees: Best Practices - Indeed You can give gift cards to your employees as presents, but your employees must then list the amount of the gift card as income on their annual taxes. Any cash or cash equivalent given by an employer to an employee is considered income by the IRS and must be taxed that way. Home Hiring resources Giving Gifts to Employees: Best Practices Are Employee Gifts Tax-Deductible? - metapress.com A gift card that costs less than $25 is not taxable. If you give a $100 gift card as an employee gift, the gift value must be included in the employee's wages. However, it is possible to give a $50 gift card to an employee that has a value of $200. In these circumstances, it is best to take a conservative approach when it comes to gift cards. Understanding the Taxability of Employee Non-Cash Awards and Gifts The Federal Tax Cuts and Jobs Act (P.L. 115-97) signed into law on December 22, 2017 changed the taxability of some non-cash awards and other gifts provided to employees. If an award or gift (or portion of an award or gift) is taxable, applicable income tax withholding and FICA taxes will be deducted from the employee's paycheck.. Beginning on April 1, 2018, departments are responsible for ...

GST and FBT - Giving vouchers to staff - TaxEd Based on the above, a gift card can be a voucher. The default position is that a supply of a voucher will be a taxable supply where the requirements of section 9-5 are met. However, where the conditions in Division 100 apply the supply of the voucher is generally not treated as a taxable supply. Are gift cards taxable income? | Taxation, fringe benefits & more While many infrequent employee gifts are deemed a de minimis fringe benefit and nontaxable, gift cards are considered supplemental income and should be included in an employee's income and thus, is taxable income. As such, the amount of the card is subject to Social Security tax and Medicare tax as well. Gifts to Employees - Taxable Income or Nontaxable Gift? All cash or gift cards redeemable for cash are taxable to the employee, even when given as a holiday gift. Monetary prizes, including achievement awards, as well as non-monetary bonuses like vacation trips awarded for meeting sales goals, are taxable compensation - not just for income taxes, but also for FICA. Withholding applies. Are Gift Cards Taxable? | Taxation, Examples, & More - Patriot Software Yes, gift cards are taxable. According to the IRS, gift cards for employees are considered cash-equivalent items. Like cash, include gift cards in an employee's taxable income—regardless of how little the gift card value is. But, there is an exception.

Know the tax rules for gifts to employees and customers - Beliveau Law But if you give an employee cash (or a cash equivalent), that's always considered wages, even if the amount is de minimis. So if you give an employee a $10 Starbucks gift card as a thank-you for working late, the $10 is considered taxable. Stock options are also taxable, and can be subject to complex rules.

De Minimis Fringe Benefits | Internal Revenue Service - IRS tax forms In addition, if a benefit is too large to be considered de minimis, the entire value of the benefit is taxable to the employee, not just the excess over a designated de minimis amount. The IRS has ruled previously in a particular case that items with a value exceeding $100 could not be considered de minimis, even under unusual circumstances.

What Employee Gifts Are Taxable? - Gift Me Your Time Unless specifically excluded by a section of the Internal Revenue Code, cash gifts, including gift cards, are considered to be taxable wages by the IRS. Are small gifts to employees taxable? Gifts from an employer to an employee are generally taxed as supplemental wages, unlike gifts made on a personal level, which are usually tax deductible.

Is a gift card or voucher from an employer to an employee taxable in ... Answer (1 of 5): As per income tax act 1961 if any gift recevied by a person in a employee-emloyer's relationship Then there may be two cases * If market price or fair market value of such gift is ₹5000 or less than ₹5000 in total then such whole amount of gift will be exempt in the hands of t...

Are Gift Cards Taxable Income to Employees? - LinkedIn If you give your employee a VISA gift card to purchase a holiday ham, it is income to the employee, subject to payroll and income taxes! Get More Help IRS Publication 15-B "Employer's Tax Guide To ...

PDF New IRS Advice on Taxability of Gift Cards Treatment of ... - IRS tax forms and any unused portion is forfeited). However, Federal tax law does not view giving an employee a turkey or a ham as the equivalent of giving an employee a gift card to purchase a turkey or a ham. A recently issued Tax Advice Memorandum (TAM) in 2004 clarifies the tax law and discusses this issue.

Tax free gifts to employees | The Association of Taxation Technicians Whilst everyone enjoys receiving presents at Christmas, employees are unlikely to appreciate gifts from their employer with a tax charge attached. Fortunately, a statutory exemption from income tax and national insurance for employees and employers exists thanks to the trivial benefit rules. The current form of these rules took effect from 6 April 2016, and the key conditions

Ask the Expert: Are All Gift Cards Taxable Income? - HR Daily Advisor So the short answer would be that any gift card that serves as a cash equivalent - for example, a $25 Amazon.com gift card or a Visa cash card - would always be taxable regardless of the amount because there is no difficulty in accounting for the monetary value of the gift.

Can I give my employee a gift card without being taxed? Because gift cards are essentially the same as cash, they are considered an easy item to be accounted for and, therefore, taxable. There used to be a threshold of $25 to be the maximum amount that could be gifted before having to be taxed, but that is no longer the case. A gift card or cash equivalent is now taxable, regardless of the amount.

Can An Employer Give A Gift Card To An Employee? However, gift cards may become a logistical headache for employers, and employees may be irritated by a tax surprise. If you insist on giving gift cards, make sure your workers are aware of the tax implications. ... They allow employers to express gratitude with a gift card which saves employees time by choosing from a variety of stores or ...

Are Employee Gifts Taxable? Everything You Need To Know Gift certificates, gift cards and cash equivalent benefits are never tax-exempt This is something the IRS is very clear about. Even if they are given out as holiday or birthday presents from an employer to an employee, these types of gifts are never considered de minimis fringe benefits, and are thus liable to taxation.

Giving Gifts to Employees? IRS Wants Its Share - WFY These perks are tax-free to employees. But any amount of cash or a comparable gift is not treated as a de minimis fringe benefit. Thus, if an employer gives an employee a $50 gift card for a store at the local mall, the employee must report the $50 "gift" as taxable income. Another Exception: Employee Achievement Awards

Are gift cards taxable employee benefits? | PeopleKeep Yes, gift cards are taxable when offered to employees. The IRS considers it as cash-equivalent, meaning you must report the card's value on an employee's Form W-2 just like a wage. This is the same as taxable fringe benefits such as employee stipends, which must also be reported as wages on employees' W-2s.

![The Gift that Keeps on Giving [to the IRS]: The Employer's ...](https://sites.psu.edu/giordanoentrepreneurshiplawblog/files/2020/03/employee-fringe-benefits-faqs.jpg)

0 Response to "39 gift card to employee taxable"

Post a Comment